We are your Legislative Voice

PDA’s Advocacy Goals

2025-26 Legislative Session

The legislative session, which begins in January 2025, allows PDA two years in which to advocate on members’ behalf for important insurance reforms, scope of practice and access to care initiatives.

Before the start of a legislative session every two years, PDA leaders carefully weigh every issue impacting the dental profession and assess Pennsylvania’s political climate before deciding which issues to advocate for on your behalf and how best to allocate PDA’s resources to achieving our advocacy goals.

PDA’s advocacy agenda for 2025/26 includes:

1) Dental loss ratio

2) Credentialing reforms

3) Network leasing notification to providers

4) Medicaid funding

The Government Relations department and Board of Trustees take seriously their role in determining how best to use PDA’s lobbying resources and PAC funds.

While we take a focused approach in limiting its primary advocacy efforts to these issues, we will monitor and address these issues on an as-needed basis:

• Licensing board advisory opinions.

• Health care provided restricted covenants.

• Teledentistry.

• Funding for the Donated Dental Services program and other oral health related programs.

• Prescription drug prescribing authority.

• Scope of practice and workforce development issues.

• All insurance issues, such as balance billing, coordination of benefits and prior authorization.

• Improving patients’ ability to access dental care.

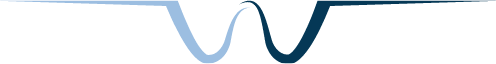

NEW! Click below for a larger version

Legislative Pipeline

Delta Dental Meeting

PDA Meets with Delta Dental

Improve Medicaid

Join the fight to improve Pennsylvania’s Medicaid program!

The need to improve the dental Medicaid program in Pennsylvania has recently been in the news and on the minds of state lawmakers. Many are expressing concern about the inadequate funding to provide comprehensive services to adults, and there is a growing consensus that Medicaid dentists are not reimbursed enough.

NOW is the time to communicate with your Representative and Senator about the need for more funding to restore Medicaid dental benefits for adults.

It’s especially important for legislators to hear from those of you who are Medicaid providers! Please share your personal experience and any difficulties you have faced with caring for your patients.

Call, email, or schedule a visit with your legislators and request their support to restore comprehensive coverage for adults.

How to contact your legislators:

Enter your home address at https://www.legis.state.pa.us/cfdocs/legis/home/findyourlegislator/ to find their contact information. Or contact PDA’s government relations team at (800) 223-0016 or mss@padental.org, and we’ll provide you with the information you need.

What we’re asking for:

That the legislature restore the adult services that were cut in 2011.

Medicaid Talking Points:

In 2011, cuts were made to the adult Medicaid program so that it no longer includes coverage for periodontal and endodontic services, crowns and caps. It also limits dentures to one per lifetime. A restoration of adult services will:

- Reduce out-of-pocket expenses for the poor. A study from CareQuest found that 93 percent of individuals living in poverty have unmet dental needs. Those who do seek care spend 10 times more of their annual family income compared to other families.

- Improve job prospects for adults who suffer from missing or unsightly teeth.

- Reduce costly emergency room visits. Pennsylvania is spending $35 million annually for non-traumatic dental care provided in ERs. o Save money in the health care system when periodontal services are provided to patients with chronic conditions like diabetes.

- Dentists are often forced into untenable positions when faced with the reality of having to pull teeth that they would rather restore, simply because Medicaid does not cover restorative services for adults.

- Less than one percent of Benefit Limit Exception (BLE) requests are approved, denying coverage to patients who need more comprehensive dental services before treatment for other health conditions like diabetes, cardiovascular disease, stroke, and Alzheimer’s disease. There is no need for the BLE process if Pennsylvania restored more comprehensive benefits for adults.

Medical Loss Ratio

PDA finds sponsor to introduce another Dental Insurance Reform bill!

PDA finds sponsor to introduce another Dental Insurance Reform bill!

Rep. Kyle Mullins is introducing legislation that would require dental insurers to report how much they spend on administrative and patient care costs (commonly referred to as Medical Loss Ratio). A law establishing a reporting requirement on an MLR for dentistry—the percentage of revenue from premiums spent on patient care—would enhance transparency for patients seeking oral health care and make dental insurers more accountable.

We need your help!

Call or email your Representative this week and ask that he/she co-sponsor Rep. Mullin’s Transparency of Patient Premiums Invested in Dental Care Act (Bill# TBA), which simply requires dental insurers to report annually their medical loss ratio (MLR) for dentistry to the Pennsylvania Insurance Department.

How to contact your legislators: Enter your home address at https://www.legis.state.pa.us/cfdocs/legis/home/findyourlegislator/ for your Representative’s contact information. Or contact PDA’s government relations team at (800) 223-0016 and we’ll provide you with the information you need.

What we’re asking for: Ask your Representative to support legislation that establishes an MLR reporting requirement for dental insurers operating in Pennsylvania. Request that he or she sign on as a co-sponsor to Rep. Mullin’s bill.

Need a few talking points to help guide your discussion? See below. Thank you for being an advocate for your profession and patients!

Medical Loss Ratio Transparency Talking points

- It is estimated that 40 percent or more of patients’ unspent premiums is used to cover administrative costs rather than the actual cost of care. Patients would benefit from knowing how much of their dental plan premium is invested in dental services rather than administrative costs. It’s time for dental insurers to be more transparent to the people they serve.

- Filing an MLR report is already a requirement under the Affordable Care Act for insurers offering medical health plans. A law establishing a reporting requirement on an MLR for dentistry—the percentage of revenue from premiums spent on patient care—would enhance transparency for patients seeking oral health care and make dental insurers more accountable. It is important for the Commonwealth to have a mechanism to obtain this information from dental insurers and make it accessible to the public.

- Four other states have laws that require MLR transparency through a reporting requirement: Maine, Arizona, California, and Washington. Several other states have introduced bills this year.

United Concordia Meeting

PDA Meets with United Concordia

Virtual Credit Card

Rep. Greg Scott has introduced “virtual credit card” legislation to prohibit dental insurers from adopting a policy that they pay dental claims using a credit or debit card equivalent only, rather than a paper check or direct deposit.

This legislation does not prohibit insurers from using virtual credit card payments altogether. It simply states that virtual credit cards cannot be the only option, requires notice to dentists of all payment options, and gives dentists the ability to opt into the payment option that works best for their dental office or facility.

We need your help!

How to contact your legislators: Enter your home address here to find their contact information. Or contact PDA’s government relations team at (800) 223-0016 or djw@padental.org, and we’ll provide you with the information you need.

What we’re asking for: Support for legislation that prohibits dental insurers from adopting a policy that they pay dental claims exclusively with virtual credit cards, requires insurers to notify dentists of other payment options, and gives dentists the ability to pick which one works for them.

Need a few talking points to help guide your discussion? See below. Thank you for being an advocate for your profession and patients!

Virtual Credit Card Talking Points (current 6/7/24):

- Some dental insurers have adopted a policy that dentists must accept claims payment using a credit or debit card equivalent, rather than a paper check or direct deposit. The transaction usually involves the insurer providing a series of numbers that the dentist enters on a website or credit card terminal to complete the claims payment. Dental practices must absorb the transaction fees, sometimes as high as five percent, or pass the additional cost on to patients. Adding insult to injury, insurers sometimes get a percentage of the transaction fee

- Many dental offices are not fully equipped to handle end-to-end electronic claims processing, in particular bulk claim payments. They may be forced to upgrade their payment system simply to be paid for services they provide to patients covered under an insurer’s plan. This unfairly restricts a dental office’s business practices and is particularly onerous for dentists who are small business owners.

- Adding additional costs in the form of transactional fees will not lower the cost of dental care for dental practices or for patients. Given that the payments from dental plans almost always represent a steep discount off dentists’ regular charges, the additional cost of these fees make staying in networks more challenging for the many dental practices with shrinking margins. It is only fair that these fees be fully disclosed so that dentists can assess their impact on the practice and determine which payment method is more financially viable.

- Processing virtual credit card payments creates an administrative burden for dental offices because they come “in bulk” with little information to distinguish which claim is being paid. More administrative hassle leaves less time for patient care.

- This legislation does not prohibit insurers from using virtual credit card payments. It simply requires insurers to provide other payment options and gives dentists the ability to opt into the payment option that works best for their dental office or facility.

- Twenty-four other states have already passed legislation prohibiting dental insurers from requiring virtual credit card payments only and requiring fee disclosure. Pennsylvania is experiencing a net loss of dentists, and we need to enact third policy payer reforms to attract more dentists.

Where does this bill stand now? PASSED!

Follow the progress on the infograph and see more details about what it took to get the bill passed!